Our classmates could not believe what they had just heard! Did our  professor really say what I think he said? As it turns out, that professor had just told us that it was not the responsibility of another to plan for our future, provide us a pension, a retirement, or even a job over the long term - it was ours! Even more, he had the nerve to tell us that companies exist to make a profit, not just to provide jobs. The year was 2000 and my twin brother, Kelly, and I had recently graduated from UNC-Chapel Hill and now found ourselves listening to an Organizational Behavior lecture in the MBA program at East Carolina University.

professor really say what I think he said? As it turns out, that professor had just told us that it was not the responsibility of another to plan for our future, provide us a pension, a retirement, or even a job over the long term - it was ours! Even more, he had the nerve to tell us that companies exist to make a profit, not just to provide jobs. The year was 2000 and my twin brother, Kelly, and I had recently graduated from UNC-Chapel Hill and now found ourselves listening to an Organizational Behavior lecture in the MBA program at East Carolina University.

While many of our friends were off to start "good-paying careers" with blue-chip companies in the prosperous early 2000s, we decided that we would prefer to gain a little more knowledge of the "business field" in graduate school (not to mention the extracurricular activities). Many folks recommended we go to work and then go back to school, but we always longed to be entrepreneurs (or whatever that was)… and thought that an MBA just might pay off one day – in a not so traditional fashion. An uncle of ours once asked Kelly, "...son, what do you plan to do when you graduate?" His response, "I'm not exactly sure but I know that I want to own my own business." I'm sure he was very impressed! Truth is, although we very much enjoyed learning (and still do to this day with a slight addiction to books and reading) we were never really fond of “traditional academia”. We just knew that hard work and determination was sure to carry us through those many late night cram sessions.

Discovering "The Good Life"

Upon graduation from ECU in 2002, we each landed jobs as commercial bankers with different financial institutions. Like many new grads, we thought we had really made it. This was going to be our ticket to the good life, right? After about 90 days of this new “good life” - what we both had suspected was in fact confirmed. We just weren’t cut out to work for someone else. But we had bills to pay so we couldn't just quit our jobs. One of the benefits of the commercial banking role was that, as lenders, we had an inside view of the financial picture of some of the bank’s wealthiest clients - as we spent hours pouring over business and personal financial statements. Soon, it was obvious to us “who had all the money”. While Kelly and I shared stories after work, we both agreed that one of the common denominators of the wealthy was that a great majority owned investment real estate - in some form. It was then that we put into practice one of my favorite quotes: "we can talk about it or we can do it." Well, like an Edwards, we didn't spend much time talking about it - we just did it!

The Start

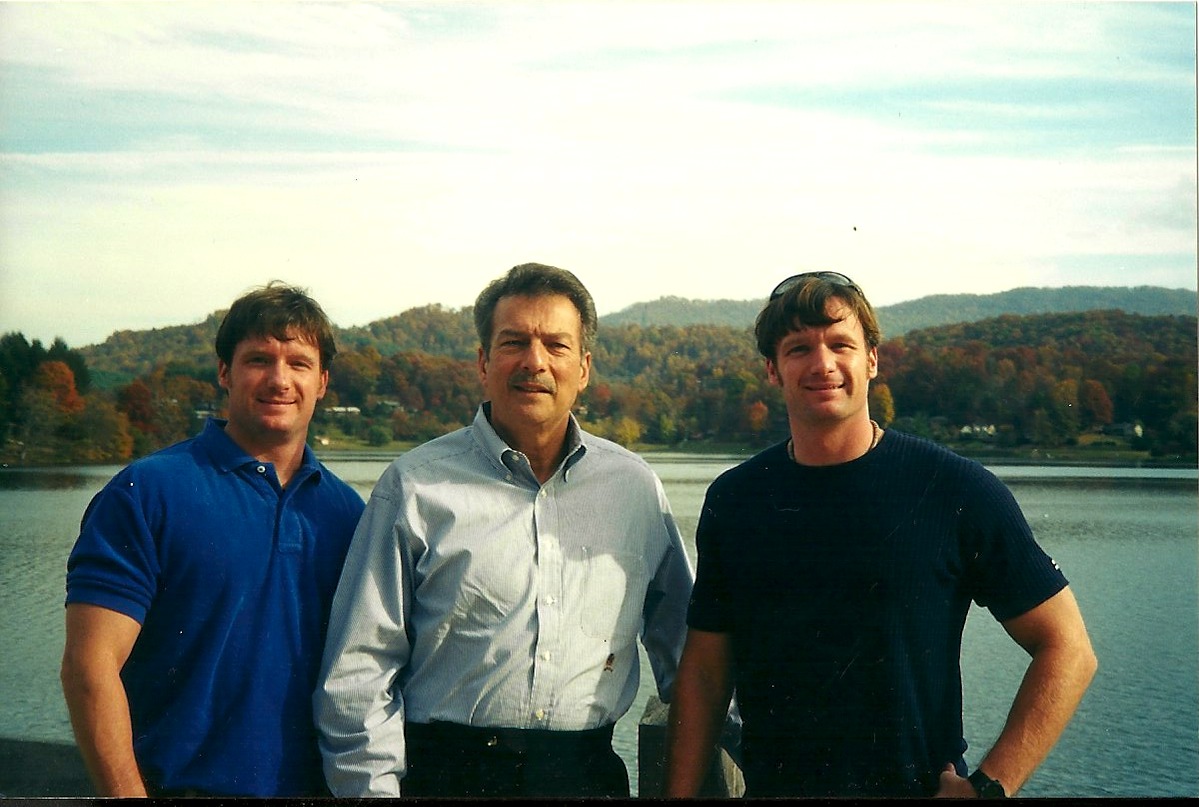

Kelly and I often joked that, "we may not always be the ‘smartest’ guys in the room, but chances are we’ll outwork everyone there." It was that grit and determination that led us to the purchase of our first investment property. We found a 1920s bungalow that was a complete wreck but was located in one of Raleigh's finest neighborhoods – Historic Cameron Village. Funny thing is, we had absolutely no idea what we were doing. After borrowing $5K from our Dad for the down payment, that beauty was ours! We literally had to jack the house up and install five additional piers just to level the floor…and that was just to get the project started! After six months and countless late nights, we were able to pay back our Dad in full and we were on our way. We close d on our second property just months later in another great Raleigh neighborhood - the Mordecai Historic District.

d on our second property just months later in another great Raleigh neighborhood - the Mordecai Historic District.

In retrospect, we purchased our first property for $88K and the second one for $175K. We still own those homes today and they are worth roughly $300K and $435K respectively, and currently renting for $1,400 and $1,800 per month. It's like we often say…. the harder you work the luckier you get! As I take a look back at that first year in the real estate business, we had one major force driving us to succeed. We desperately wanted to be free - one day - to chart our own course, set our own schedule, and not rely on someone else to define our professional and financial future. As strong believers in personal growth and goal-setting we had established a goal to become millionaires by our 30's. We’ve had our setbacks, with some being bigger than others, but we hit our mark and kept moving forward.

Brick by Brick

As big ECU Pirate fans, one of Head Football Coach Ruffin McNeil's often repeated coaching philosophies certainly resonates with our "story". Successful programs and businesses don't achieve their success overnight - although at times it may look that way from the outside. That "success" is most often created when no one is watching - during the seemingly endless nights and weekends - working until 2:00 a.m. In other words, they're built "Brick by Brick" (as Coach McNeil likes to say about his program)...and that's the way we'll continue to do it - steady success built over the long term. As it turns out, our professor was right…. it really isn't anyone’s job - except our own - to define and chart a course for our future. But isn't it just like academia to define the problem but fail to give you the solution? Well, we figured out the solution but as they say, "that's another story for another day."

Stay tuned for details of the “solution” in upcoming blog posts.

Do you have questions about Real Estate investing? Want to schedule a phone call or one-on-one coaching session with Kelly Edwards & Chris Edwards, Managing Principals of The Edwards Companies? Click here to learn more...

www.TheEdwardsCompanies.com

Comments

{tag_commentspaged}